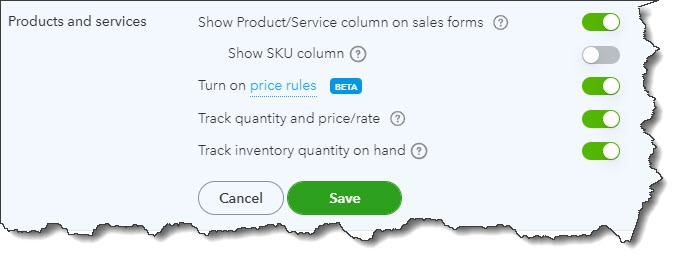

How QuickBooks Online Tracks Products and Services, Part 1 What products and services does your company sell? Do you have enough to fulfill existing and future orders? QuickBooks Online can tell you. Most small businesses maintain a changing inventory of multiple products. Even if you sell one-of-a-kind goods, you need to know what you’ve sold… Continue reading How QuickBooks Online Tracks Products and Services

Tag: QuickBooks Online

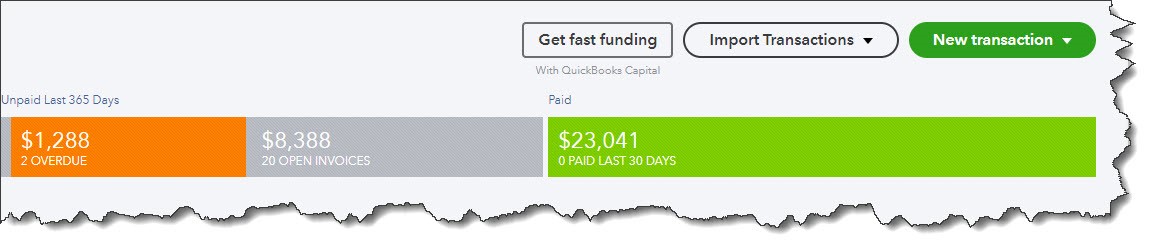

Quickbooks Online Provides Ways to Know Which Customers Owe You Money and Who Is Late

Keeping Up With Receivables: Know Who Owes You QuickBooks Online provides numerous ways for you to know which customers owe you money – and who is late. There are so many financial details to keep track of when you’re running a small business. You have to make sure your products and services are in good… Continue reading Quickbooks Online Provides Ways to Know Which Customers Owe You Money and Who Is Late

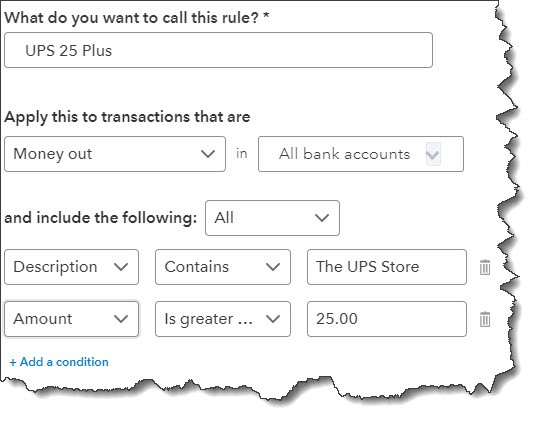

Too Many Transactions in QuickBooks Online? Create Rules

It’s important to categorize transactions, but it takes time. If every day brings several dozen into QuickBooks Online, you can automate this process. One of the cardinal rules of accounting is this: Go through your new transactions every day. If you wait until there are too many of them, you’re likely to give them short… Continue reading Too Many Transactions in QuickBooks Online? Create Rules

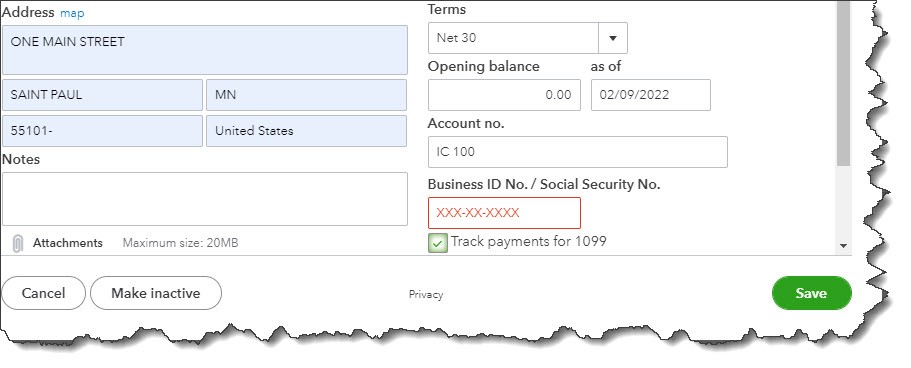

Hiring An Independent Contractor? How QuickBooks Online Can Help

Are you taking on a worker who’s not an employee? QuickBooks Online includes tools for tracking and paying independent contractors. The COVID-19 pandemic created millions of self-employed individuals and small businesses. Whether they chose to, or circumstances forced them to, these new entrepreneurs had to learn new ways to get paid and to prepare their… Continue reading Hiring An Independent Contractor? How QuickBooks Online Can Help

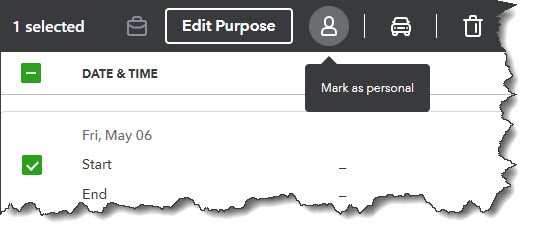

How QuickBooks Online Helps You Track Mileage

With gas prices so high, you need to track your travel costs as closely as possible. Consider getting a tax deduction for your business mileage. If you drive even a little for business, it’s easy to let mileage costs slide. After all, it’s a pain to keep track of your tax-deductible mileage in a little… Continue reading How QuickBooks Online Helps You Track Mileage